The definitive guide to immediate transfer and its automation

2026-02-15

If you have ever wondered what an immediate transfer is, the answer is straightforward: it is a payment that reaches the destination account in under 10 seconds. Forget waiting for the next business day. This service runs 24 hours a day, 7 days a week, including holidays.

What an immediate transfer is and its impact on treasury

The concept of “instant” has completely changed the rules of the game in corporate financial management. We are not just talking about paying faster but about a strategic tool that brings a new level of agility to treasury. For an SME, where every euro and every minute counts, being able to move money instantly is a huge competitive advantage.

Think about it: you can settle an invoice with a supplier just in time for them to send urgent goods, pay last-minute payroll without anyone worrying, or process a refund to a customer on the spot and leave them happy. The key here is certainty: both you and the recipient have payment confirmation within seconds.

An immediate transfer is not just a faster version of the traditional one. It is a shift in how liquidity is managed. It removes the uncertainty of timing and lets businesses operate with much more precise, almost real-time cash flow control.

The new standard in Spain

In Spain, this technology has not only arrived to stay but has taken over. We are the clear leaders in Europe in the use of SEPA immediate transfers. No less than 53% of all transfers are now instant, a figure far ahead of the European average of 15%. This Bank of Spain data makes it clear: immediacy is no longer an option; it is the norm.

This mass adoption almost forces businesses to get on board to stay competitive. Handling urgent payments or securing funds for a critical operation is part of daily life. In a pinch, having quick liquidity options is vital for treasury health and for dealing with the unexpected.

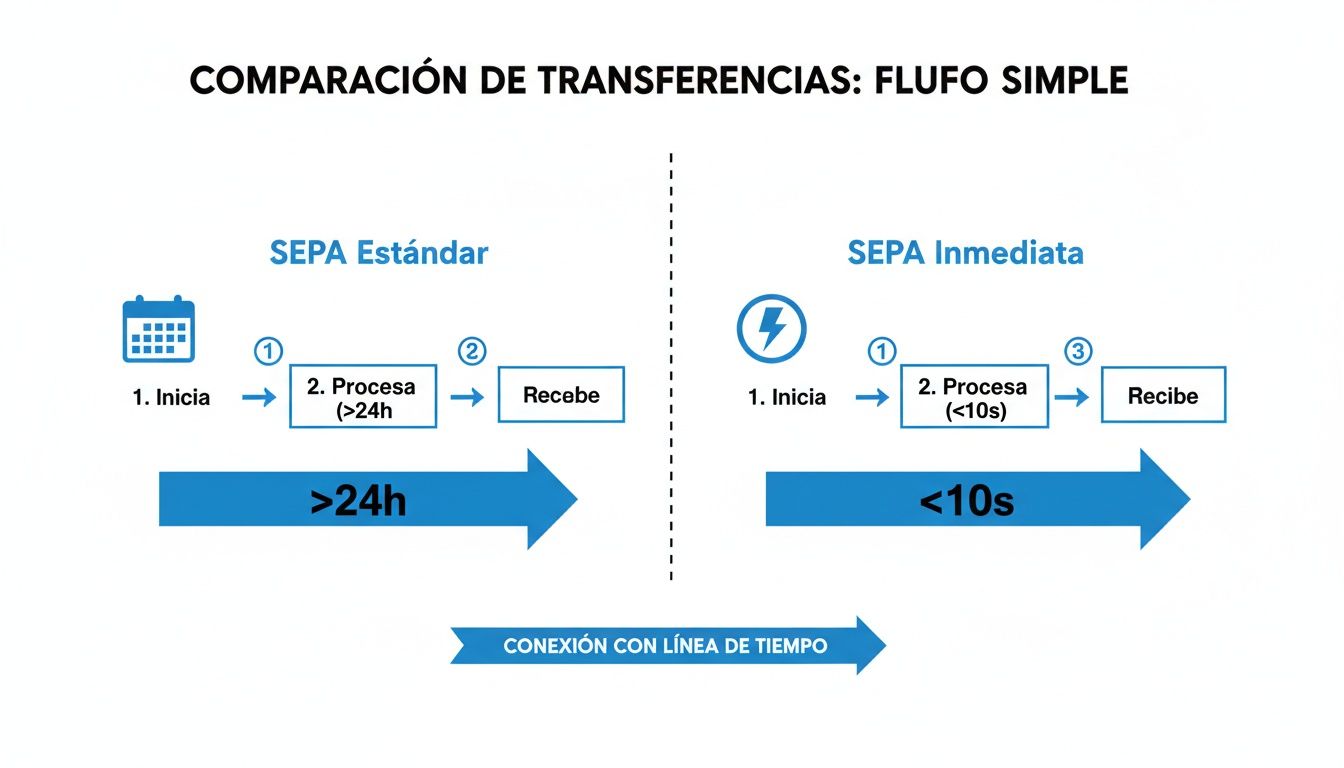

To understand why it matters so much, the best approach is to compare it head to head with its older sibling, the standard SEPA transfer. If you are interested, you can learn more about SEPA bank transfers and their basics on our blog.

Immediate transfer vs standard SEPA transfer

To help SMEs understand the main differences, we have put together a direct comparison between immediate transfers (SEPA Instant) and ordinary SEPA transfers. The differences go well beyond speed and affect availability, cost and financial planning itself.

This table summarises the key points every business should be clear on.

| Feature | Immediate Transfer (SEPA Instant) | Standard SEPA Transfer |

|---|---|---|

| Speed | Under 10 seconds | 1–2 business days |

| Availability | 24 hours, 7 days a week, 365 days a year | Banking hours, business days only |

| Amount limit | Up to €100,000 per operation (subject to bank limits) | No standard limit, set by the bank |

| Irreversibility | Once sent, it is irrevocable and cannot be cancelled | Cancellation can be requested before processing |

| Cost | Usually a small fee or free | Often free, depending on the bank |

| Confirmation | Instant notification of delivery or rejection | Confirmation can take hours or days |

As you can see, the choice between one and the other depends entirely on the urgency and nature of the operation. While the standard transfer remains useful for planned, non-urgent payments, the immediate one has become the perfect tool for managing the “now”.

Your money’s journey in 10 seconds

Sending an immediate transfer is a lot like sending a WhatsApp. You hit “send” and, in the blink of an eye, the message is on the recipient’s phone. With money something very similar happens: thanks to a perfectly synchronised technological choreography, the funds travel from your account to your supplier’s in under 10 seconds. And the best part: it makes no difference if it is Sunday or a holiday.

This speed is not magic but the result of solid infrastructure that works 24/7. When your company gives the payment order, there are no queues or waits until the next business day. The instruction is sent instantly over secure digital channels in a process that needs no human intervention.

The main players in immediacy

For this lightning operation to work, several key actors have to work in coordination. Think of it as a high-speed relay race where every runner is essential for the baton to reach the finish on time.

The main participants are:

- Your bank (the ordering institution): The starting point. It receives your order, checks immediately that you have funds and that the data is correct. Then it “packages” the money and payment information in a secure digital message.

- The clearing house (the referee): In Spain, this role is mainly played by Iberpay. It is a neutral, ultra-fast intermediary that receives the order from your bank and directs it to the recipient’s bank in milliseconds. Its job is to settle the operation and ensure the money moves correctly and securely.

- The beneficiary’s bank (the receiving institution): It receives the message from the clearing house, processes it instantly and credits the funds to the destination account. To close the loop, it sends a confirmation back.

This whole flow of communication and settlement happens in the time it takes to blink, ensuring that whoever receives the money can use it almost immediately.

Think of the instant payment system as the central nervous system of the financial sector. It connects thousands of points (banks) through a network that transmits information and value at breakneck speed, ensuring each payment reaches its destination reliably and on time.

The diagram below shows very clearly the huge difference in timing between a standard and an immediate transfer.

The image leaves no room for doubt: while traditional payments depend on banking cycles and opening hours, immediate transfers have completely removed those time barriers.

A secure, always-on network

The reliability of this system rests on very strict security protocols and constant availability. The network is built to process a massive volume of simultaneous operations without breaking a sweat, giving businesses peace of mind that their most urgent payments will be executed without a hitch.

To understand the value of this immediacy, it helps to compare it with options for sending money around the world quickly and securely. Putting it in perspective helps us appreciate the simplicity and speed we have in the SEPA area, where technology has turned what used to take days into an operation of seconds.

How do I prepare my company for instant payments?

For the agility of an immediate transfer to become a real advantage for your business, your systems need to speak the same language as your bank. And no, I do not mean clicking a button. I mean automating payment batches, where the dialogue between your software and the financial institution has to be smooth and, above all, error-free.

That common language is called SEPA (Single Euro Payments Area), and its format is XML. Specifically, to order payments a standard file type known as pain.001 (Payment Initiation) is used. Think of it as a certified, perfectly structured shipment order you give your bank with all the instructions ready to be executed instantly.

The SEPA XML standard for automating your payments

When you have to pay dozens of suppliers or employees, doing it one by one is unthinkable. What you need is a system that groups all those orders into a single file your bank can process in one go. The pain.001 format is the norm across Europe for exactly that reason.

Inside that file, every piece of data has its place:

- Who pays: Your IBAN, your company name and its tax ID.

- Who gets paid: The beneficiary’s IBAN, name, exact amount and payment concept.

- When it is paid: The execution date you choose.

Building this XML file by hand is madness—a technical task full of pitfalls. One tag not closed, one mandatory field missing, and the bank will reject the entire batch. Result: delays, phone calls and a serious administrative headache.

The importance of validating the IBAN, the most critical data

In an immediate transfer, which is irrevocable, the most sensitive data is without doubt the recipient’s IBAN. A simple slip of the digits, a typo, and you have a problem.

If you send a payment to the wrong IBAN, you have two scenarios, and neither is good:

- The IBAN does not exist: Just as well. The bank will reject the order, but it will probably charge you a fee for the failed attempt.

- The IBAN exists but belongs to someone else: Here the nightmare begins. The money will reach a stranger, and getting it back will depend on their goodwill.

So validating every IBAN before generating the batch is not an option; it is a must. There are tools that check on the spot whether the format is correct and the check digits add up. They are your first line of defence against human errors that cost money.

Think of IBAN validation as the spell-checker for your finances. Before sending an important email, you use the checker. Same before sending money: automatic validation ensures your instructions are correct and saves you returns and trouble.

What if my system uses legacy formats like Norm 34?

Many companies, especially those that have been in the Spanish market for years, still use accounting or ERP systems that produce files in old formats like AEB Norm 34. Those formats did their job, but today they are incompatible with modern online banking, which only understands SEPA XML.

Many SMEs face a dilemma: spend a fortune updating their software or keep managing payments by hand. Fortunately, there is a much smarter third way.

Tools like ConversorSEPA act as a universal translator. They let you keep exporting payment data from your usual programs in formats you know—Excel, CSV or old Norm 34. The platform takes that file and converts it, instantly and securely, into a perfect SEPA XML pain.001 file ready to upload to your bank.

This solution saves you expensive migration projects and opens the door to automation and immediate transfer for any company, whatever technology it uses.

How to automate your payment batches step by step

Moving from managing payments by hand, with all the time and errors that involves, to an automatic, reliable system is much easier than it seems. Forget complex IT projects or needing technical knowledge. Today, with the right tools, you can have your transfer batches ready in minutes, prepared for your bank to process in one go.

The process can be summed up in three very logical steps, designed for any admin department. It is a sequence built to eliminate errors, save hours of work and give you full control over your payments.

Step 1: Upload your original payment file

The starting point is the file you already use day to day. Most SMEs work with payment lists in spreadsheets, exports from their ERP or even old banking formats.

You do not need to change the way you work. Simply take that file and upload it to a conversion platform. The most common, and usually accepted without issue, are:

- Excel files (.xls or .xlsx): The go-to in almost every office for tracking supplier payments or payroll.

- CSV files (.csv): A very simple, lightweight text format, ideal for exporting data from almost any management software.

- Legacy AEB formats (Norm 34, 14, etc.): If your system still produces these files, do not worry—you do not have to throw them away.

The key is this flexibility. The idea is that technology adapts to you, not the other way around. No more wasting time transforming your data by hand to fit a specific template.

Step 2: Map your data with a visual interface

Once you have uploaded the file, the crucial moment arrives: telling the system what each column is. This is called “mapping the data” and in practice it is as simple as drag and drop.

Think of it like this: you have two boxes. In one, the labels from your file (e.g. “Supplier IBAN”, “Invoice Amount” or “Beneficiary Name”). In the other, the labels the SEPA standard needs (“Creditor IBAN”, “Amount”, “Creditor Name”). Mapping is simply connecting each label in your box with its equivalent in the SEPA box.

Visual mapping is like giving your spreadsheet a translator. You teach it once what each column means, and the tool will remember those instructions for future files, fully automating the process next time.

The big advantage is that it is a very intuitive, visual process. You do not have to write a single line of XML code. You just connect the fields and the system handles the technical part. Once done, you can save that setup as a template and reuse it whenever you want.

Step 3: Download your validated, ready-to-use XML file

With the mapping done, you only have to press a button. In seconds, the tool processes your file and generates a SEPA XML pain.001 file with the right format and already validated.

This is where the real magic happens. During that conversion, the platform automatically runs critical checks:

- IBAN validation: It ensures each IBAN has the correct structure and valid check digits. This saves you a lot of hassle with returns. If you are interested, you can learn more about how a SEPA file validator works and why these checks matter.

- Mandatory field check: It verifies that all the data the bank needs (name, tax ID, concept, etc.) is there and in the right format.

- Data security: Once the file is generated, serious platforms apply very strict security protocols. For example, they often automatically delete all uploaded data after a very short time, such as 10 minutes, to ensure your sensitive financial information is never exposed.

The result is a bulletproof XML file you can upload directly to your bank’s online banking, confident it will be accepted first time.

Advanced integration for full automation

For companies that handle a large volume of payments or have technical teams, there is another level of automation. Through a JSON API, the company’s ERP or management software can be connected directly to the conversion service.

What does that mean? That the process of generating the SEPA XML file can be completely invisible to the user. The internal system sends the payment data to the API and receives in return the XML file ready to send to the bank, without anyone having to do anything manually. It is the definitive way to integrate immediate transfer at the heart of a company’s workflows.

Practical applications that transform your business

The theory behind immediate transfer is fine, but its real value shows when it solves the day-to-day problems of an SME. Automating these payments is not a minor improvement; it is a lever that speeds up critical operations, strengthens trust and optimises your treasury in tangible ways.

Let us see how this technology, combined with efficient batch management, marks a before and after in very concrete situations. The key is not just paying faster but operating much more intelligently.

Urgent payroll and key supplier payments

Picture the scene: it is the end of the month and, due to an oversight, one payroll was left out of the main batch. Before, the solution was to apologise, make a manual transfer that would take a business day to arrive and, in short, create a rather awkward situation with the employee.

With automation and immediate transfer, the story changes completely. You simply generate a single payment file for that payroll, convert it to the correct SEPA XML format with a tool like the SEPA converter, upload it to your bank and in under ten seconds the employee has the money in their account. Problem solved and trust intact.

The same goes for suppliers. Imagine one of your strategic suppliers calls: if they do not receive payment for the last invoice within an hour, they cannot release the material you urgently need to avoid stopping production.

- Before: A race against the clock, calls to the bank, nerves on edge and the real risk of a stock-out that would cost you much more money.

- After: You create the payment order, process it as an immediate transfer and send the proof to the supplier in minutes. The supply chain keeps moving and your commercial relationship is stronger.

Radical improvement in e-commerce customer experience

E-commerce lives on immediacy and customer satisfaction. And believe me, slow payment handling can ruin the best shopping experience.

Think about a refund. A customer returns a product and naturally expects their refund. If it takes several days to arrive, their perception of your brand suffers. If you automate refunds with immediate transfers, the customer gets their money almost as soon as you process the refund in your system. It is a detail that builds strong loyalty.

Another typical case is payment by transfer to release an order. If a customer chooses this method, they traditionally had to wait for the money to show in your account, which could easily delay shipping by one or two days.

By enabling instant payments, the customer pays, you get confirmation in seconds and you can start preparing the shipment straight away. This agility translates directly into happier customers and better ratings for your business.

Treasury optimisation in accounting and advisory firms

Accounting firms move a massive volume of payments for many clients: taxes, social security, payroll… The manual process of preparing and sending all those batches is a huge bottleneck, a source of potential errors and a time sink.

Automating batches with immediate transfers changes the game. An accounting firm can prepare payment files for all its clients in their usual format (e.g. a simple Excel), convert them in one go to SEPA XML and schedule their submission.

This not only saves countless hours of administrative work but also gives much more precise treasury control. Funds leave clients’ accounts exactly when needed, without “floating” in the banking system for days. The result is smoother, safer, more scalable operations that let the firm offer a much more valuable service.

Common mistakes when sending batches: how to protect your payments

There is one feature of immediate transfer that makes it a double-edged sword: it is irrevocable. The moment you press send, there is no going back. A small mistake can be very costly, so every batch demands maximum rigour and a “zero errors” mindset.

Unlike a standard transfer, where you sometimes have a brief window to cancel the operation, here the money lands in the destination account in under 10 seconds. That removes any chance of correction. Prevention is therefore not an option; it is your only strategy.

Mistakes usually come from human error or technical issues, but the result is always the same: a financial problem. A mistyped IBAN, an XML file the bank rejects on a technicality or a security gap when handling data are real risks that can leave your payments in limbo.

The most dangerous mistakes (and how to stop them)

The good news is that most of these risks can be neutralised with a good protocol and the right tools. It is not about working more but about working smarter.

Almost all problems centre on these three hot spots:

- Typographical errors in the IBAN: The classic of classics and the one that causes the most headaches. If you get it wrong and the incorrect IBAN belongs to someone else, recovering the money can be a real legal odyssey.

- Incorrect file format: Your bank expects to receive a flawless SEPA XML

pain.001file. One tag not closed or one mandatory field empty can cause the entire batch to be rejected, leading to delays and forcing you to start again. - Insecure data handling: Using spreadsheets without control or emailing lists with sensitive banking data is an invitation to disaster. The risk of unauthorised access and fraud shoots up.

Think of a batch as a chain: its strength is that of its weakest link. Validating every IBAN, ensuring the file format is correct and protecting data are the three links that must never break.

Your final validation checklist before hitting “send”

To sleep well, the best approach is to build a final checklist into your payment process. It is a safety net that will only take a few minutes but can save you hours of trouble.

Before sending any batch, pause and review these four key points:

- Confirm the total: Does the total amount of the batch match your forecasts and accounting records?

- Validate every IBAN: Use a tool that checks the structure and check digits of all IBANs in the file. Do not rely on sight alone.

- Check the XML format: Confirm the file fully complies with the SEPA

pain.001standard and has no errors. - Verify the execution date: It seems obvious, but mistakes here are easy. Is the payment date correct, especially if you are scheduling it?

Tools like ConversorSEPA automate much of this work, acting as a digital supervisor. Their proactive validation of format and IBANs catches errors before the file even reaches the bank, protecting your treasury in a smart, effective way.

We answer the most common questions about immediate transfer

However agile a system is, questions always come up on the go. That is normal. Here we answer directly the most typical doubts we see in companies when they start using immediate transfer. That way you have all the key information to hand.

How much can I send with an immediate transfer?

Officially, the limit set for the whole SEPA area is 100,000 euros per operation. That is the maximum amount the European infrastructure guarantees for this type of send.

There is an important nuance, though: each bank can set its own rules. It is very common for institutions to apply lower limits, such as €15,000 per transfer or a daily cap. So before organising an important payment, the first step is to check your bank’s conditions so you do not get a surprise.

What happens if an immediate transfer fails?

This is one of the system’s great advantages: speed for everything, including errors. Forget the uncertainty of traditional transfers, where a rejection could take hours or even a day to be notified. Here the response is almost instant.

If the operation is rejected (because the IBAN is wrong, there are insufficient funds or the destination bank is not on the SEPA Instant network), you will know within seconds.

And most importantly: if a payment is rejected, the money never leaves your account. That gives you huge peace of mind, because you can correct the error on the spot and try again without having to wait for the funds to be returned.

Can I cancel an immediate transfer I have already sent?

The answer is short and clear: no. Once you have confirmed the order, the operation is completely irreversible. The money reaches the beneficiary’s account in under ten seconds and from that moment there is no going back. There is no “cancel” button.

This brings us to a key point: verification is crucial. Before pressing send, you have to be one hundred per cent sure of the data. Check the IBAN, amount and recipient name two or three times if need be. If you make a mistake, the only way to get the money back is to contact the person who received it and ask them to return it.

Do immediate transfers work with all banks?

Although their use in Spain is almost universal and keeps growing in Europe, not all banks in the SEPA area have joined the system yet. The vast majority of large, well-known institutions have, but some smaller or niche banks may not yet offer this service.

A good tip is to check whether your beneficiary’s bank accepts them before making an urgent payment. The good news is that most online banking platforms make it easy: when you enter the IBAN, the system usually tells you whether the immediate send option is available for that recipient.

With ConversorSEPA you can prepare your payment batches securely and efficiently, generating validated SEPA XML files ready for your bank in minutes. Simplify your treasury management and eliminate manual errors at the official ConversorSEPA website.