The definitive guide to SEPA direct debit for businesses

2026-02-13

Think of the subscription models that are so successful today, like Netflix or Spotify. Imagine being able to apply that same logic of automatic, recurring collection to your own business. Well, that is exactly what a SEPA direct debit allows you to do: a system to request payments directly from your customers’ bank accounts, always with their prior permission. For thousands of SMEs in Spain, it is the cornerstone of their treasury.

What is a SEPA direct debit and how does it transform your collections?

In short, a SEPA direct debit is an authorisation, a “permission”, that a customer (the debtor) gives you, their supplier (the creditor), so that you can initiate collections from their bank account. The main advantage is that it removes the need for the customer to intervene manually in each payment, whether by making a transfer or paying by card.

It is like building a direct, automated highway for your income. Instead of chasing invoices or hoping customers remember to pay, the money flows on time and predictably into your account on the due date.

This system is a lifeline, especially for businesses with recurring income, where a stable cash flow is key to survival and growth.

Why it is vital for your business

Adopting SEPA direct debit is not just a process improvement; it is a strategic decision with a direct impact on your company’s financial health. Its real value lies in how it systematises collections, removing uncertainty and a huge administrative burden at a stroke.

The benefits are clear:

- Sharp fall in late payment: By automating the process, delays and non-payment drop. The system handles everything without depending on the customer remembering or having time.

- Predictable cash flow: You know exactly when and how much you will collect. This lets you plan your finances with much more peace of mind, manage stock and decide when to invest.

- Time and resources freed up: Your team stops wasting hours on repetitive tasks like sending reminders or reconciling payments. That time can go on what really matters: growing the business.

In essence, a SEPA direct debit is the contract that allows payments to flow without friction from the customer to your company. It formalises a relationship of trust and efficiency, turning sporadic collections into a steady, reliable income.

The context of the Single Euro Payments Area (SEPA)

The key word here is SEPA (Single Euro Payments Area). It is not just a technical acronym; it is the initiative that has made all of this possible. SEPA unifies euro transactions across 36 European countries, so that a direct debit or transfer within Spain works exactly like one with a customer in Germany.

Thanks to SEPA, you can collect from a customer in France or Italy as easily and at the same cost as if they were in your own city. Banking barriers and the hassle of selling abroad are a thing of the past.

Since it was introduced in 2009, direct debit has kept growing. In Spain it is already the second most popular non-cash payment method, after transfers. SMEs, which make up 99% of our business base, have adopted it en masse, reducing their late payment by between 30% and 40%. To dig deeper into these figures, the Treezor.com guide on SEPA direct debit has very useful data.

In short, this system rests on three pillars: automation, efficiency and security. It is the tool that turns collection management from a headache into an agile, fully predictable process.

Which SEPA direct debit scheme suits you best: CORE or B2B?

When it comes to collecting by direct debit, not all SEPA schemes are the same. You have two options: CORE and B2B, and the choice depends on something very simple: who are you collecting from? A consumer or another business? Understanding this is crucial, because it determines the security of your collections and the stability of your treasury.

The SEPA CORE scheme: the universal option with consumer protection

Think of the SEPA CORE scheme as the standard option, the default. It is designed to protect the end consumer (B2C or Business-to-Consumer) as much as possible, the party the system considers most vulnerable in a transaction.

Its best-known feature—and sometimes a headache for businesses—is the refund period. A consumer can return a collection within the first 8 weeks from the collection date. And importantly: they do not need to give any reason. This safety net for the customer naturally introduces an element of uncertainty for whoever issues the collection.

This no-questions-asked refund right is the cornerstone of the system. If a customer does not recognise a charge or simply changes their mind, they only need to ask their bank to return it, and the bank will do so.

What is more, if the collection was made without a valid SEPA mandate, things get more serious. In that case, the period to claim a refund goes up to 13 months. Precisely because of this strong protection, the CORE scheme is the only one you can use to collect from consumers. You can also use it with businesses or self-employed who prefer to keep these rights.

The SEPA B2B scheme: the fast, secure route for business

On the other side we have the SEPA B2B (Business-to-Business) scheme. This is the tool designed exclusively for transactions between professionals, where the rules are completely different. Here the priority is speed and, above all, the finality of the collection.

The logic of B2B is simple: two businesses are assumed to negotiate on equal terms. So the right to refund is removed so that, once collected, the money stays where it is.

When a business signs a B2B mandate, it explicitly waives its right to return the collection. What does this mean in practice? That once the payment has been processed, it is final. There is no going back. This characteristic secures the operation and gives the creditor full financial certainty. To find out more about how these collections are organised, we recommend our article on what is remittance in accounting.

SEPA direct debit CORE vs B2B scheme comparison

To show you the differences at a glance, we have put together this table. It summarises the key points to help you decide which scheme best fits your customers and your operations.

| Feature | SEPA CORE (B2C) | SEPA B2B (Business) |

|---|---|---|

| Target audience | Consumers, self-employed and businesses. | Businesses and self-employed only. |

| Refund right | Yes, up to 8 weeks with no explanation required. | No, the debtor waives this right when signing the mandate. |

| Refund period | 56 calendar days (8 weeks) for justified or unjustified refunds. | 2 business days only and only if the operation was not authorised. |

| Submission deadlines | 5 business days before first collection / 2 days for subsequent ones. | 1 business day before the collection. |

| Collection certainty | Lower, as there is always a refund risk. | Maximum; the collection is effectively irrevocable. |

As you can see, the differences are huge. The B2B scheme is designed to give certainty to business-to-business transactions, while CORE prioritises protection of the individual consumer.

Tools like ConversorSEPA make managing this very simple. When preparing your collection files, the platform lets you choose whether the batch is CORE or B2B with a single click.

That way you ensure the XML file you generate meets all the correct technical specifications for each type, avoiding errors that could delay your collections.

Choosing between CORE and B2B is not a mere technicality. It is a strategic decision that directly affects your cash flow and how you manage risk. Whenever you deal with other businesses, using the B2B scheme will give you invaluable peace of mind and strengthen your financial position.

The SEPA mandate: the contract that authorises your collections

If SEPA direct debit is the tool for collecting, the SEPA mandate is the legal permission your customer gives you to use it. It is not just a piece of paper; it is the cornerstone of the whole system. It is, in essence, the formal agreement by which your customer authorises you to charge their bank account.

Think of it as the modern, standardised European version of the classic direct debit agreement. This document creates a relationship of trust and transparency between your company (the creditor) and your customer (the debtor), making the rules clear for both.

Without a valid, properly signed mandate, any collection you try to make is up in the air and could be returned. Every time you create a batch, you are in fact exercising the right that this document gives you.

The data that cannot be missing from a valid mandate

For a SEPA mandate to be legally valid, a simple verbal agreement is not enough. It must include a set of mandatory data that identifies it beyond doubt. If any is missing, the customer’s bank will most likely reject not only that collection but the entire batch.

Make sure every mandate you issue always includes:

- Unique Mandate Reference (UMR): Like the ID of that agreement. A unique code (up to 35 characters) that you assign to identify it.

- Full creditor identification: Your name or company name, your address and, very importantly, your SEPA Creditor Identifier. This is the code that authorises you to issue direct debits.

- Full debtor identification: The full name (or company name) of the account holder and their address.

- Debtor bank details: The IBAN of the account you will charge.

- Payment type: It must be clear whether collections will be recurring (for instalments or subscriptions) or a one-off payment.

A properly completed mandate is much more than a formality. It acts as a shield, ensuring that every collection is backed by explicit authorisation. This greatly reduces the risk of refunds and disputes.

The lifecycle of a SEPA mandate

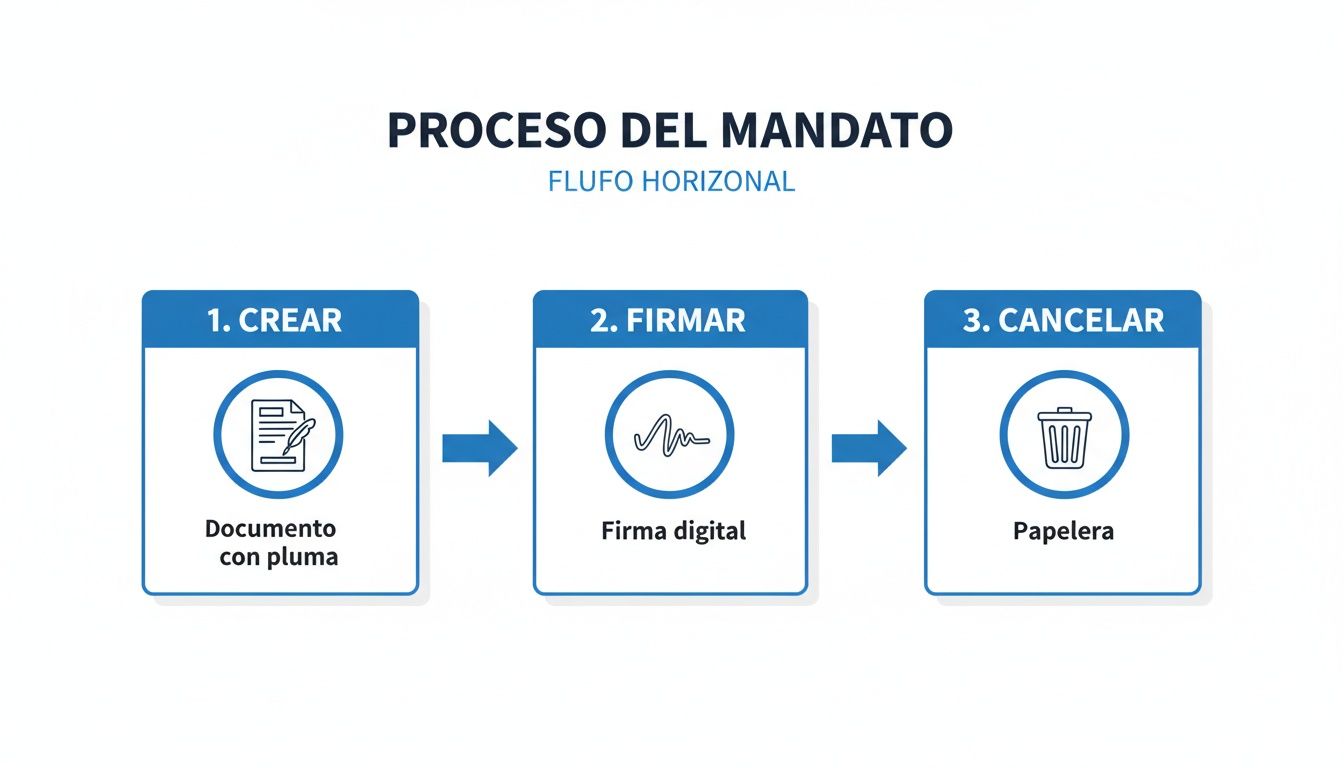

A mandate is not something you sign and forget. It has a lifecycle with three phases that you need to manage well for your collections to run smoothly: creation, custody and cancellation.

It all starts with creation and signature. You gather the data and your customer must sign. Although paper signatures are still an option, electronic signature has become the standard for speed and security. It complies with the European eIDAS regulation and greatly speeds up onboarding.

Once signed, you have a legal obligation to keep the original mandate. The regulation requires you to retain it for at least 36 months after the last collection. This document is your evidence if a customer ever disputes a charge. To find out more, we recommend our complete guide to the SEPA mandate.

Finally, a mandate can be cancelled, either by you or by the customer. Also note that if a mandate goes 36 consecutive months without use, it lapses automatically. If you wanted to collect from that customer again, you would need them to sign a new one.

Tools like ConversorSEPA take a lot of the weight off this. They not only help you create batches but also generate mandates in PDF ready to sign, so you do not miss any mandatory field. That way the foundation for your recurring collections is solid and reliable.

The journey of a direct debit batch, step by step

Imagine it is billing day and you are about to launch your subscription collections. From the moment you press the button until the money reaches your account, a standardised, precise process is set in motion, like a financial choreography. Understanding this journey gives you full control over your collections.

This path, which might once have seemed a bureaucratic maze, is now a logical sequence of steps you can manage with agility thanks to technology.

The full SEPA direct debit process is divided into several key stages, each with its purpose and deadlines. Knowing them is essential to avoid delays, unexpected refunds and, in short, to protect your treasury.

Stage 1: Advance notice to the debtor

Before touching your customer’s account, SEPA regulation requires an essential courtesy: communication. You must send them advance notice, known as pre-notification, to inform them that you will be making the charge.

This notice must state at least the exact amount and the date on which the collection will be made. The general rule is to send it 14 calendar days in advance, although this can be negotiated and shortened with your customer in the mandate itself.

Why does it matter? Simple: it gives them time to ensure they have funds. That way you avoid one of the most common and frustrating refunds: insufficient funds.

Stage 2: Preparing and converting the batch

With the notice sent, it is time to prepare the collection order. You will probably have all the information in a spreadsheet, Excel or CSV, with the usual columns: name, IBAN, amount and mandate reference.

But here is the crux: banks do not understand spreadsheets. The SEPA system has its own universal language, a format called XML (based on ISO 20022). It is the only “dialect” your bank will accept for processing direct debits.

This is where tools like ConversorSEPA become your best translator. You upload your Excel file and the platform turns it instantly into a well-structured, validated XML file ready to send. The diagram below shows very clearly how a mandate is managed from creation to cancellation.

As you can see, the mandate lifecycle has three key moments: creation, the signature that gives it legal validity and, finally, cancellation when the commercial relationship ends.

Stage 3: Submitting the batch to the bank

With your XML file ready, the next step is to upload it to your online banking. Here the calendar is your best friend, because deadlines are strict and vary by type of direct debit.

- SEPA CORE direct debits: For the first collection under a direct debit or for a one-off payment, you must submit the batch at least 5 business days before the collection date. For subsequent collections in the same series, the deadline relaxes to 2 business days.

- SEPA B2B direct debits: Designed for speed between businesses, so the deadline is much shorter. You only need to submit the batch 1 business day before the collection date.

Missing these deadlines is a beginner’s mistake that costs dearly: the bank will reject the entire batch, forcing you to start again and delaying your income.

Stage 4: Collection process and handling refunds

If you have followed every step, on the due date you specified the money will be debited from your customer’s account and credited to yours. Goal achieved. But the journey does not always end there. Sometimes refunds come knocking.

It is vital to understand the deadlines and reasons. SEPA direct debits in Spain are governed by strict submission and refund deadlines under Royal Decree-Law 19/2018. For CORE direct debits, the customer has up to 56 days (8 weeks) to return a collection without giving a reason. Under the B2B scheme, however, the debtor waives this right and can only return it within 2 days for technical reasons.

This clear legal framework has made direct debits very popular, already representing 14% of all non-cash payments. Tools that validate the IBAN before issuing the collection are key to minimising the typical 2–3% rejection rate. To go deeper into the regulation, you can explore how SEPA direct debits work on Sage.com.

When a collection is returned, your bank notifies you with an error code (e.g. MS02 for insufficient funds or MD01 for account no longer existing). Your job is then to analyse that code, talk to the customer to resolve the issue and, if appropriate, re-issue the collection in a future batch.

How to convert Excel to the XML format your bank requires

We come to what is usually the biggest headache for most SMEs that manage collections by direct debit: creating the SEPA XML file. It may sound very technical and intimidating, but understanding why this format exists is the first step to mastering it without the stress.

For years in Spain we worked with the famous “banking books” (do the 19, 34 or 58 ring a bell?). They were home-grown file formats specific to the Spanish banking system. But with the arrival of SEPA regulation, Europe needed a single language, a standard that all banks would understand. The one chosen was the international ISO 20022 standard.

This change required all banks to retire the old formats and require their customers to provide an XML file with a very specific structure to process any SEPA direct debit batch.

The anatomy of a SEPA XML file

Despite its imposing name, an XML file (for direct debits, pain.008.001.02) is just a text file. Think of it as a Word document, but instead of paragraphs it uses “tags” to organise the information for each collection.

These tags tell the bank what each piece of data is: <Nm> for the debtor’s name, <Amt> for the amount to be collected, <IBAN> for the account number. Each collection is packaged in its own block of tags, and the set of all of them forms the batch. The aim is simple: so that any bank in the SEPA area, whether Spanish, German or Italian, can read and understand it without doubt.

Understanding the “why” of this format is far more important than mastering the technical “how”. You do not need to be a programmer to generate these files; you just need a tool that acts as your translator.

The solution: tools that speak the bank’s language

And this is where technology saves the day. Instead of wrestling with the XML structure or risking a silly mistake that makes the bank reject the entire batch, you can use specialised platforms.

These tools work in a very simple way: 1. Upload your collection file: The same Excel or CSV you use for your accounts, with your name, amount and IBAN columns. 2. Map the columns: You tell the platform “this column in my Excel is the customer name” and “this one is the IBAN”. 3. Generate the XML: With one click, the tool turns your data into a perfect, validated XML file ready to upload to your online banking.

These solutions are remarkably efficient and, today, almost essential. To give you an idea, in the first half of 2025 the volume of SEPA direct debits in the euro area reached 11.3 billion operations. For SMEs that manage their batches in Excel, tools like ConversorSEPA are key to adapting, facilitating conversion to ISO 20022 XML format (the successor to the old Book 19.14) and validating data like the IBAN to save you hassle and error fees. If you are curious, you can see more on ECB payment statistics on their official site.

One step further: automation for higher-volume businesses

For businesses that handle a higher volume of operations or want to integrate everything into their systems, the next level is automation. Instead of uploading files by hand, you can connect your invoicing software or ERP directly to a conversion service via an API.

What does that mean? When you close an invoice in your management software, it can automatically send the information to the conversion platform and receive, instantly, the XML file ready for the bank. Without anyone having to do a thing.

Whether manual or automated, having a SEPA converter is the safest and fastest way to clear the XML technical hurdle. It lets you keep working with the tools you already know, like Excel, while meeting the bank’s strict requirements.

Frequently asked questions about SEPA direct debits

Even with such a standardised system as SEPA direct debit, day-to-day doubts always arise. That is normal. This final section goes straight to the point to answer the most common issues, so you can resolve any incident quickly and keep your treasury healthy.

We will focus on the three questions we get most from businesses that, like yours, manage direct debit batches.

What do I do if a customer returns a CORE collection?

It is one of the most frustrating situations, yes, but also one of the most common. When a customer returns a collection issued under the CORE scheme, the first impulse may be to run it again and keep your fingers crossed. But believe me, having a clear method will save you a lot of headaches.

First, find out why it was returned. Your bank will give you a return code (the famous “R codes”), which is the clue you need. It is not the same when a collection is returned for insufficient funds (code MS02) as when it is rejected because the account no longer exists (MD06).

Once you know the reason, communication with your customer is key.

- Call or write, but be proactive: Get in touch in a friendly way to inform them of the return. Explain the reason (if you know it) and look for a solution together.

- Agree the next step: Ask if you can run the collection again on a specific date or if they prefer to pay you this time by another means, such as a transfer.

- Update your data: If the problem was an incorrect IBAN, make sure you correct it in your system. This may mean you need them to sign a new SEPA mandate.

Re-issuing a direct debit without speaking to the customer first is bad practice. Not only is it very likely to be returned again; it damages the business relationship and the trust that took so long to build.

Only when you have fixed the cause of the problem can you include the collection again in your next batch. This approach not only helps you collect but strengthens the relationship with your customer by showing transparency and professionalism.

Can I change the amount or date of a recurring collection?

Yes, of course you can, but never on your own and without telling them. The SEPA mandate your customer signed in its day is an agreement based on very specific conditions. If those conditions change, whether the instalment amount or the collection day, you have an obligation to notify them.

Imagine you raise the price of your monthly subscription. Before running the charge with the new amount, you must tell the customer with the notice you have agreed. The general rule talks about 14 days’ notice, but you may have agreed something else. In practice, this notification is like a small update to the original agreement.

The same goes for the date. If you always collect on the 1st and decide to change it to the 5th, you have to tell them.

The key here is transparency. An unexpected change in the amount or date is one of the most common reasons for return. Advance notice is not just a courtesy; it is a requirement for the collection to be legitimate and to avoid unpleasant surprises with returns you could have prevented.

What do the R return codes mean?

Return codes, or “R codes”, are the language banks use to tell you why a SEPA direct debit has failed. If you learn to interpret the most common ones, you can act immediately and know exactly what to do.

Although the full list is quite long, in practice you will almost always see the same ones. Here is a quick reference to the most common and how to act:

- MD01 - Incorrect account (Invalid Account Number): The IBAN you have does not exist or has an error.

- Solution: Call your customer to verify and correct the account number. You will need them to sign a new mandate with the correct data.

- MS02 - Debtor deceased / Insufficient funds: Although the code covers two very different situations, in Spain it is almost always used to indicate that there was not enough balance.

- Solution: Talk to the customer to agree a new collection date, a day when they know they will have funds available.

- MD06 - Account blocked / closed (Account Blocked): The customer has closed that account or the bank has blocked it for direct debits.

- Solution: Ask your customer for a new account number and, of course, a new mandate. There is no point trying again on that account.

- MD07 - Debtor has cancelled the authorisation (Debit Authorisation Cancelled by Debtor): Your customer has instructed their bank not to accept any more charges from you.

- Solution: Do not run the collection again. First contact the customer to understand why they cancelled the direct debit and find an alternative.

Knowing these codes is like having a quick diagnosis of the problem. It lets you stop guessing and apply the right solution first time, speeding up your collections and keeping your business administration in much better shape.

Managing SEPA direct debit batches does not have to be an ordeal. With clear information and the right tools, you can turn a process full of pitfalls into a simple, almost automatic task. At ConversorSEPA we have built a platform that lets you convert your Excel files to SEPA XML in seconds, validating data to reduce returns and ensuring you always comply with the regulation.

Try ConversorSEPA free for 7 days and simplify your collections from today